How to spot a credit card skimmer

Credit card skimmers are devices that criminals use to capture card details, and they’re typically fixed onto real card readers to trick customers. Fraud involving these devices results in significant financial losses for both consumers and financial institutions each year.

This article offers guidance on identifying credit card skimmers, explains how they operate, and outlines the various types of skimmers. It also sheds light on safe shopping habits and provides general advice on what to do if your card is skimmed.

What is a credit card skimmer, and how does it work?

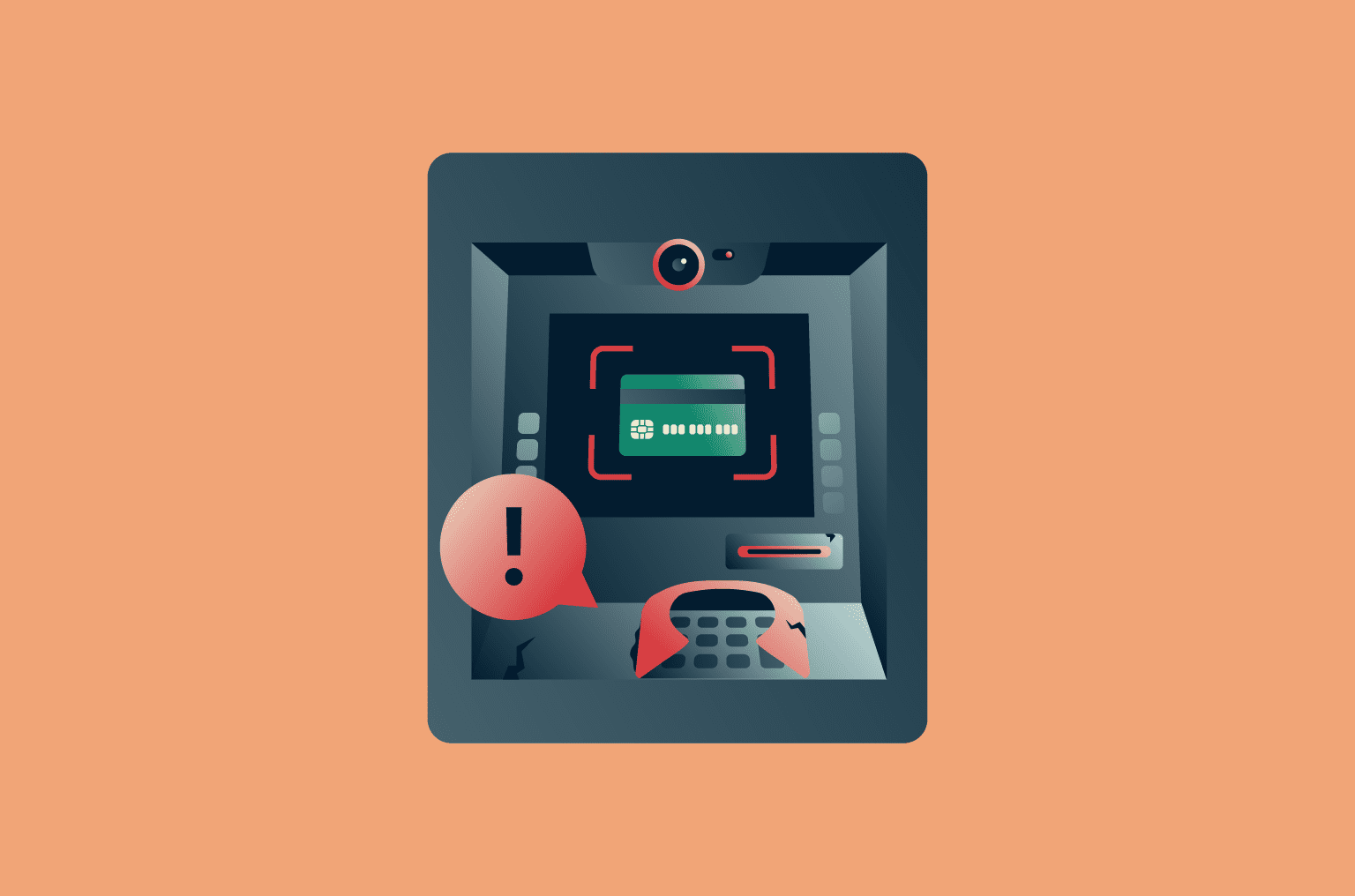

Credit card skimmers are deceptive card-cloning devices that criminals attach to legitimate card readers on ATMs, point‑of‑sale terminals, or fuel pumps to steal payment data.

Credit card skimmers are deceptive card-cloning devices that criminals attach to legitimate card readers on ATMs, point‑of‑sale terminals, or fuel pumps to steal payment data.

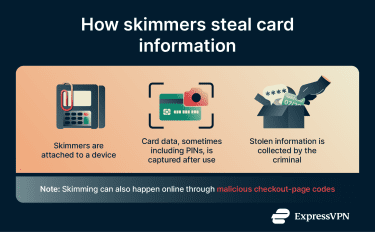

When the victim inserts their card in an ATM or swipes their card, the skimmer silently copies information from the magnetic stripe and may also record the PIN using a hidden camera or a fake keypad. Afterwards, the criminals retrieve this data either by removing the device or by downloading it wirelessly.

Please note: Magnetic stripes are an older and inherently insecure payment technology that’s gradually being phased out in favor of Europay, Mastercard, Visa (EMV) chip and contactless payments. When an EMV chip is used, it generates a unique, one-time code for each transaction, making intercepted data useless for card cloning.

Today, many banks restrict magnetic-stripe transactions to limited fallback scenarios (such as certain ATMs), and merchants often avoid them because fraud liability typically falls on the merchant.

Skimmers come in several forms. For example, fake card readers may use overlay devices that fit over the card slot or keypad, while internal skimmers sit inside hard-to-see places, such as the fuel pump cabinet or inside an ATM, and are therefore more difficult to detect. Some internal skimmers are integrated with Bluetooth modules, so criminals can download stolen data without ever returning to the machine.

In some cases, fuel pump skimmers are installed inside the pump after a criminal compromises it. Because gas pumps can harbor hidden skimming devices, many fuel stations now use tamper‑evident seals or some modern pumps that disable payment when the cabinet is opened. If the seal has been broken, the pump may have been tampered with.

Other ways cards can be skimmed

Fraudsters have developed multiple techniques to obtain payment information beyond attaching a basic overlay device. Understanding these methods can help you stay vigilant about this kind of theft. Here are some of the more common methods:

- Digital or web skimming: Criminals plant malicious code on online shopping platforms using vulnerabilities found within software. This online skimmer then captures card numbers and personal details as they are entered and sends the data to remote servers. Digital skimming can impact thousands of customers at once.

- Camera-based card data exposure: Many businesses have cameras pointing at registers to monitor activity. If a card has sensitive information on the front, it may be possible for a bad actor with access to the camera feed to capture some card information.

- Wireless skimming: Some people worry that criminals could steal their card details by wirelessly scanning contactless cards. In practice, however, this type of attack is pretty rare. While it’s technically possible to read some data from a contactless card at very close range, the necessary equipment for transactions is very specialized, difficult to purchase, and would need to be connected to a payment processor or bank. Rather than stealing card data, the more realistic risk is fraudulent charging using a real or modified point-of-sale (POS) device, especially for small contactless transactions that don’t require a PIN. However, POS devices are tightly controlled by banks and payment processors, making abuse difficult, and reported fraud is typically refunded.

Signs of a credit card skimmer

Identifying a skimming device can be difficult because criminals design them to blend in with legitimate machines. However, there are some common warning signs to watch out for.

How to spot skimming device red flags

Visual checks may help identify obvious signs of tampering, but they can’t reliably detect sophisticated skimmers. If something about a machine looks unusual, such as components that appear out of place, inconsistent with nearby terminals, or different from what you’d normally expect, that could be a sign that it’s been tampered with. It can also be a red flag if one ATM or payment terminal lacks features (such as contactless payments) that are supported by similar machines nearby. When in doubt, it’s safer to avoid the terminal and choose another option.

Review the location

Some locations are more likely to be targeted by criminals than others. Exercise caution when using ATMs or fuel pumps in isolated, poorly lit, or low-traffic areas, as these are more attractive targets. Machines that seem neglected, outdated, or poorly maintained may also be at higher risk.

If a terminal is far from the store entrance, not under visible surveillance, or unattended for long periods, it’s a good idea to choose a different machine if possible. Skimmers are less likely to persist in locations that are busy, well-lit, and regularly monitored by staff or cameras.

What can happen if my card gets skimmed?

If your card is skimmed, a criminal may be able to use the captured card number and expiration date to make unauthorized purchases, especially online (card-not-present fraud). Small test charges are often used to verify whether the card details are still active before selling the information to someone else.

The stolen details can also be used to create cloned cards or sold to other criminals. While skimming doesn’t automatically lead to full-blown identity theft, skimmed payment data can be used as part of broader misuse or identity fraud schemes if it’s combined with other compromised information. Victims often don’t realize the theft has happened until they see suspicious activity on their accounts.

What to do if your card was skimmed

If your card was skimmed, it’s important not to panic, but you should act quickly. There are several steps you can take immediately to mitigate the potential damage.

- Stop using the card: If you suspect that your card information has been compromised, stop using the affected card immediately.

- Document everything: Make a note of when and where you believe the fraud occurred, and keep any receipts or documentation that could help an investigation. Document all aspects of the situation, as your logs may help the bank or law enforcement’s investigation.

- Contact your bank or card provider: Call the customer service number on the back of your card or visit your bank in person. Report the incident, request a new card, and ask the issuer to monitor your account for suspicious activity. Some issuers offer zero‑liability policies for fraudulent charges under certain conditions.

- Report the skim to consumer protection agencies: Reach out to your local government agency in charge of handling fraud, such as the U.S. Federal Trade Commission (FTC) or the relevant consumer protection agency in your country. While this isn’t likely to restore your lost funds, the agency can use the information you provide to investigate the criminal. Your details may also be used to help prevent future skimming crimes.

- Report it to the store or bank: Contact the employee on duty or the bank itself and explain what happened. If the skimming devices are still active, they can help take them down before other people are victimized.

- Report to law enforcement: File a report with your local police department. A police report helps document the incident, supports your bank’s investigation, and may contribute to broader law enforcement efforts against skimming operations. In the U.S., you can also submit details to the FBI’s Internet Crime Complaint Center (IC3) if appropriate.

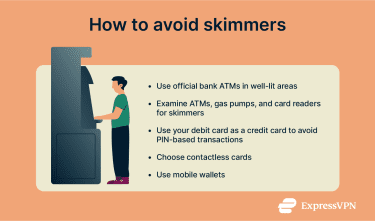

How to avoid card skimming

To ensure you don’t fall victim to skimming, you’ll need to stay vigilant and maintain healthy shopping habits.

Safe ATM and POS terminal behaviors

Safe habits at the point of sale can help reduce your chances of falling victim to credit card fraud. According to the credit-scoring firm Fair Isaac Corporation (FICO), the majority of ATM skimmers are placed on non-bank ATMs, so where possible, use an ATM at an official bank branch or in a well-lit building with active employee surveillance over the ATM. And while buying gas, make the purchase inside the store whenever possible, as this prevents any potential pump skimmers from capturing your details.

Always shield the keypad with your hand when entering your PIN. Skimming setups often include hidden cameras designed to capture PINs, and covering the keypad helps prevent this information from being recorded.

If your bank supports it, use the cardless option for ATMs. These allow you to withdraw or deposit money using near-field communication (NFC) or a QR code paired with the bank’s mobile app or your digital wallet.

If available, you can also choose the “credit” option when paying with a debit card. Although this doesn’t prevent the skimmer from stealing your card’s data, it’s often easier to reverse credit card charges than debit card charges.

Additionally, you should monitor your bank account and follow safe banking principles to make sure you catch any suspicious activity early.

Using contactless or mobile payments

Contactless cards and mobile wallets use NFC to transmit encrypted payment tokens. Each transaction generates a one‑time code, so intercepted data can’t be reused.

Mobile wallets add biometric or passcode authentication and don’t transmit your actual card number. Although no method is completely immune to fraud, NFC and tap-to-pay transactions are generally considered safe, as Radio Frequency Identification (RFID) skimming is difficult in practice and typically yields little usable data for fraudulent transactions.

How to protect your card details online

Skimming is usually a physical payment fraud method, but there is digital skimming or web skimming as well. Digital skimming occurs when malicious code is added to an online checkout page to capture payment details as customers enter them. One way to protect yourself from digital skimming is to use a virtual card for your online shopping.

Virtual cards are digital versions of your physical cards with a different number, issued by your bank. They’re often single-use, tied to one store, or have a low limit, meaning that even if a bad actor were able to get that card’s details, the damage they could do would be minimal.

Tokenized payment options like Apple Pay or Google Pay are also a safer choice because you’re not entering your payment information online.

Whichever payment method you choose, it’s always a good idea to stick with well-known sellers and watch for signs of fake sites.

FAQ: Common questions about credit card skimmers

How common is credit card skimming?

Skimming is well-documented but relatively limited. Even though it doesn’t affect most cardholders, fraud monitoring firms track thousands of skimming-related compromises each year. For example, Fair Isaac Corporation (FICO) reported that in 2024, more than 231,000 U.S. debit cards were compromised in skimming incidents, affecting about 3,300 financial institutions.

Why do skimmers target gas stations and ATMs?

Gas stations and ATMs are attractive to criminals because their card readers are publicly accessible and sometimes unattended. Additionally, many pumps and ATMs have security vulnerabilities that can be exploited if a user doesn’t notice the skimmer.

Are contactless cards safer against skimming?

Yes, they are generally safer because they tokenize important details, apply encryption, and don’t require you to insert your card completely or swipe it.

Do credit card skimmers need your PIN to steal from you?

No, not always. Some skimmers are designed to capture card details and expiration dates, which can be enough to use your card in many online storefronts or other ways that don’t require a PIN. Without a PIN, it’s harder for a criminal to use your card everywhere, but they don’t necessarily need your PIN code to start using your card.

Take the first step to protect yourself online. Try ExpressVPN risk-free.

Get ExpressVPN