Citibank scams explained: Warning signs, prevention tips, and recovery steps

Scammers often target Citibank customers, sometimes misusing Citibank’s name to make fake messages seem legitimate or impersonating trusted authorities to commit financial fraud. They trick recipients into transferring money or sharing personal information, which they can then sell or use for fraudulent purposes.

Understanding how Citibank scams work helps to spot warning signs early and respond safely. This guide covers the most common Citibank scams, how to recognize them, and what to do if you come across one.

What are Citibank scams?

Citibank scams are fraudulent schemes that impersonate Citibank or trusted authorities associated with the bank to steal personal information, login details, one-time passwords (OTPs), or money and gain access to accounts.

They typically begin with phishing phone calls, text messages, emails, or fake websites and can lead to unauthorized access to accounts, financial loss, and, in some cases, identity theft.

How do Citibank scams work?

Citibank scammers use social engineering tactics to manipulate and trick people into compromising their accounts.

Most follow a predictable pattern. Here’s how a typical Citibank impersonation scam works:

- Initial contact: The scammer contacts the target by phone, text, email, or a fake website that mimics Citibank’s branding. For example, they may claim to be from Citibank's fraud department and alert the victim to "suspicious activity" on their account.

- Building credibility: To appear trustworthy, the scammer might provide partial account details (sometimes obtained through data scraping or breaches). They may also use caller ID spoofing to display Citibank's official number or reference real Citibank services to lower the victim's guard.

- Request for information: They may ask the target to “verify” their identity or “secure” their account by providing login details, OTPs, or card information. They might also get the victim to click a malicious link or install remote access software.

- Unauthorized activity: With access, the scammer may be able to transfer money, make purchases, or add new payment methods. Stolen details may also be used for identity theft.

- Delay and cover-up: The scammer may block access to the account or instruct the target not to contact the bank, buying time before the fraud is discovered.

Ways Citibank scams are delivered

Most scams targeting Citibank customers fall under the umbrella of impersonation, in which scammers pose as Citibank representatives or other trusted entities to obtain sensitive information or direct transfers.

The most common delivery methods for these types of scams are:

- Phishing emails: Fraudulent emails that appear to come from Citibank often use email spoofing, where attackers forge sender addresses and replicate official branding to make messages look legitimate.

- Vishing (voice phishing): Scammers may use caller ID spoofing to make their phone numbers look like Citibank’s official lines or local branches.

- Smishing (SMS phishing): Fraudulent text messages that mimic Citibank alerts by copying official language and formatting.

In recent years, the Federal Trade Commission (FTC) reported that Citibank was among the top four banks targeted by bank-impersonation text scams.

Common types of Citibank scams

Most scams targeting Citibank customers involve impersonation, but they can take different forms. The following are some of the common types of scams used to gain access to personal information or funds.

Account issue scams

These scams impersonate Citibank directly and exploit fears about account security or suspicious activity. Scammers contact victims, claiming there is a problem with their Citibank account, such as unauthorized transactions, account locks, or security breaches, and urge immediate action to resolve it.

They may:

- Request login credentials, OTPs, or card details under the guise of verifying identity or stopping fraud.

- Direct victims to click malicious links or download software purportedly to “secure” the account or investigate issues.

- Use any access they may have gained to initiate unauthorized transfers, add new payment methods, or change account settings.

Because these scams often use information gleaned from data breaches or prior interactions, they can appear highly convincing. This is why it’s essential to verify any suspicious communications directly with Citibank through official channels.

Tech support scams

This is when scammers impersonate Citibank security or tech support. They may claim the account or device is at risk of fraud and urge victims to install remote access software to investigate or resolve the issue.

If connected, scammers may be able to watch the screen as victims enter banking details or one-time codes. They may then be able to use this to log in, add payees, and initiate transfers.

Recruitment scams

Recruitment scams use fake job offers to trick victims into sending money or sharing financial details. While these scams are not tied to Citibank specifically, they often rely on access to victims’ bank accounts or cards, including Citibank accounts, to move funds or make payments.

Scammers send unsolicited job offers (through messaging apps, texts, or email), promising high pay for simple tasks. They claim victims are hired immediately and direct them to a website or app for "work."

Common variations include:

- Affiliate marketing job scam: Targets sign up via links, sometimes downloading an app, and pay upfront for job packages, where they're given easy tasks like promoting content. Scammers may offer small initial payments to build trust before requesting additional payments. Eventually, commissions stop, and victims can't get refunds.

- Mobile app job scam: Scammers tell victims to download a fake app for jobs, such as shopping, to earn commissions. They add funds or transfer money to accounts provided by scammers. These apps may show "earnings," but nothing can be withdrawn.

Investment scams

This is often tied to cryptocurrency or other “exclusive” opportunities, where scammers persuade victims to “invest,” promising big returns with little risk, and they may mention Citibank or another financial institution to make it seem trustworthy.

They reach out by phone, message, or ads, then ask for money to be sent to unfamiliar accounts or crypto wallets. Once the transfer is complete, the funds disappear.

Debt relief scams

These scams offer to erase or lessen Citibank debt through “special programs” that promise fast approval. The scammer pretends to be from Citibank or a helpful lender and asks for an upfront processing or guarantee fee. Once paid, they disappear.

Malware scams

Malware often infiltrates devices via phishing links or during fake tech-support calls. It’s sometimes disguised as a helpful app, and once installed, fraudsters may be able to gain permissions such as screen sharing and remote access.

With this, scammers may be able to monitor the screen in real time and capture banking logins, one-time codes, and other sensitive details. Remote access software might also allow scammers to initiate unauthorized transactions directly from Citibank accounts.

How to spot Citibank scams

Citibank scams are often subtle and designed to emotionally hook the victim, but you can still learn to spot them by watching out for certain telltale signs, including:

- Unsolicited requests: Citibank won't ask for sensitive information, such as your account balance, debit PIN, CVV, or Social Security number, through phone calls, emails, or text messages.

- Pressure to act quickly: Messages or calls that urge immediate action are intended to prevent victims from pausing to verify requests.

- Suspicious contact methods: Unsolicited messages or calls claiming to be from Citibank can be a warning sign, particularly if they instruct you to click a link, download software, or call back using contact details included in the message. Scammers may use caller ID spoofing or forged sender information to make these communications look authentic.

- Unusual payment requests: Demands to wire funds, buy gift cards, or send money to unknown accounts for processing fees, refunds, or security holds are signs of a scam.

- Unrecognized transactions or account activity: Charges on statements you don’t remember making, unfamiliar logins or inquiries on your credit report, or sudden problems accessing your account are early signs of compromise from a scam.

- Lookalike addresses and URLs: Watch for fake or similar-looking email addresses or web links that mimic the official Citibank site but have slight misspellings, extra characters, or different extensions, and URLs that redirect to fraudulent pages.

- Unrealistic offers: Promises of high investment returns, quick debt relief for Citibank balances, or instant high-pay jobs connected to Citibank, especially when they require upfront fees, personal details, or transfers, point to a scam.

How to keep your Citibank account safe

Citibank has built-in security features, many accessible via the Citi Mobile App or your online account, to help protect your bank account from unauthorized access and fraud.

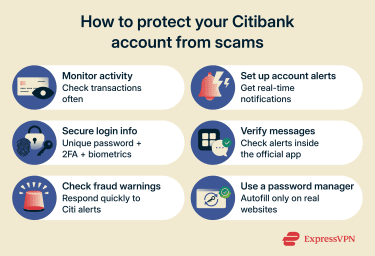

Monitor your account regularly

Citibank recommends making account check-ins a habit to detect suspicious transactions early. If you find one you don’t recognize, you can raise a transaction dispute online in CitiManager. You can also contact customer service by calling the number on the back of your card.

Set up Account Alerts

Citibank’s Account Alerts feature lets you customize the notification type and frequency to stay updated on what’s happening with your account, whether it's through email, phone, or text.

Secure your Citibank login with strong authentication

Your Citibank login is the first line of defense against scams. Start by using a strong, unique password that you don’t reuse on any other website or app.

If scammers obtain one password, they can use it to access other accounts if the passwords are the same or some variation of the breached one. This strategy, known as credential stuffing, accounted for 22% of data breaches in 2025, according to Verizon’s Data Breach Investigations Report (DBIR).

Next, enable two-factor authentication (2FA) so Citi requires an additional one-time code when you sign in or perform sensitive actions. This helps protect you if attackers obtain your password. For added protection and convenience, turn on biometric authentication (Face ID or fingerprint) in the Citi Mobile App.

Strong authentication also helps protect against brute-force attacks, where attackers use automated tools to repeatedly guess passwords at high speed. While this isn't usually how Citibank scams begin, scammers could launch them after collecting leaked or partially known credentials from phishing campaigns or compromised devices.

Verify alerts through another channel

If you’re unsure about a Citibank notification you received, open the official Citi Mobile App or manually type Citi’s website into your browser and check your account activity there. If an alert is legitimate, it should appear inside your account dashboard. Confirming communication across multiple channels makes it easier to determine whether a message is real.

Use Citi’s Fraud Early Warning

Unlike Account Alerts, Citi’s Fraud Early Warning system is designed to catch suspicious activity early, often before you even notice it yourself. If Citi detects unusual card activity, they may contact you by text, email, phone, or mail to confirm whether a transaction is legitimate.

Keeping your contact details up to date is critical, as delayed responses give scammers more time to act.

Use a password manager

Password managers securely store your login credentials in an encrypted vault and automatically generate long, unique, and complex passwords for each site.

Most password managers also include an autofill feature, which will also only enter credentials on the official website. This can help spot phishing attempts. If a scammer directs you to a lookalike Citibank site, a password manager won’t autofill your credentials, providing an immediate warning sign that something isn’t right.

What to do if you receive a suspicious Citibank message

- Think before acting: Scammers often rely on quick actions, such as clicking links, downloading apps, installing software, making payments, or sharing codes. Pausing to verify independently prevents the scam from progressing.

- Refrain from disclosing any information: Don’t share confidential details such as account numbers or passwords.

- Verify the contact independently: End the interaction and avoid calling back using numbers or links provided in the call, email, or text. Instead, use the official contact details on the back of the card, in statements, or on the Citi website and app.

- Report the incident: Report the scam on the official Citibank website. Additional reports to local law enforcement or the FTC can help protect others by raising awareness and sharing details about specific scammers. Depending on your specific circumstances, you may be eligible for reimbursement if you lost money.

Learn more: How to report identity theft

FAQ: Common questions about Citibank scams

What is the official fraud reporting number for Citibank scams?

Citibank advises its customers to report Citibank scams by calling the official phone number printed on the back of their card or by contacting Citi through the official website or mobile app. This is because scammers often spoof numbers to appear legitimate, so relying on contact details received via text, email, or phone can lead back to the scammer.

Is there a Citibank text scam?

Yes, Citibank text scams are common. They impersonate the bank and claim to have detected suspicious activity, account problems, refunds, or unpaid charges. These messages are used to steal login details, card information, or one-time passwords (OTPs). Legitimate Citibank text messages will not ask for sensitive information or direct customers to click unfamiliar links.

What should I do if I fall victim to a Citibank scam?

If you fall victim to a Citibank scam, stop engaging with the scammer immediately and contact Citibank through official channels to report the fraud. Change your Citibank password right away, freeze or lock affected cards, and monitor your account for unauthorized activity. If personal or financial information was exposed, consider reporting the incident to the Federal Trade Commission (FTC).

What are common tactics used in Citibank scams?

Common Citibank scam tactics include impersonating bank representatives, using urgent language to pressure victims, spoofing caller ID or email addresses, sending phishing links, and requesting sensitive information such as passwords or card details. Some scams also involve directing victims to install remote access software or malware, allowing scammers to take control of devices and accounts.

How do I protect my personal information from scams?

Personal information is best protected by limiting when and how it’s shared. Passwords, one-time passwords (OTPs), and card details shouldn’t be disclosed in response to unexpected calls, texts, or emails, even if they appear to come from Citibank.

Does Citibank reimburse scam victims?

Citibank may reimburse scam victims in certain situations. It isn’t guaranteed and depends on the circumstances of the fraud, how quickly it was reported, and whether required security steps were followed. Customers are encouraged to report suspected fraud immediately, as delays can affect eligibility for reimbursement.

Take the first step to protect yourself online. Try ExpressVPN risk-free.

Get ExpressVPN