Nigerian prince scam: What is it and how to stay safe

The Nigerian prince scam is a form of advance-fee scam where a scammer convinces a victim to send them money upfront for a promised reward later. It’s sometimes called a 419 scam, referencing Section 419 of the Nigerian Criminal Code.

This scam dates back to the early days of email and online communication. World governments have warned about it, and it’s popped up in countless TV shows and movies. However, despite widespread public awareness, people continue to fall victim to this scam every day.

This guide explains the history of the Nigerian prince scam, how it works, and how to protect yourself.

What is the Nigerian prince scam?

The Nigerian prince scam is a well-known form of email fraud where scammers pose as foreign royalty, wealthy officials, or individuals tied to a large inheritance. It’s most famously associated with someone pretending to be a Nigerian prince, but it isn’t limited to that scenario.

The scammer contacts the victim via a phishing email or phone call and tells them a story: a Nigerian prince needs help moving a vast sum of money out of the country due to political turmoil, banking restrictions, or legal complications. They promise the victim a lucrative reward for helping out.

However, to get the money, the victim must first pay a series of “processing fees,” “taxes,” or “legal costs.” Normally, these payments start small but increase over time as the scammer invents new hurdles. Sometimes the victim is even asked to provide sensitive banking details. Eventually, the scammer disappears, leaving the victim empty-handed.

For some victims, it gets even worse. Scammers sometimes use victims as money mules by getting them to move funds between accounts or transfer stolen funds. When investigators begin searching, they’ll see a breadcrumb trail leading right to the victim.

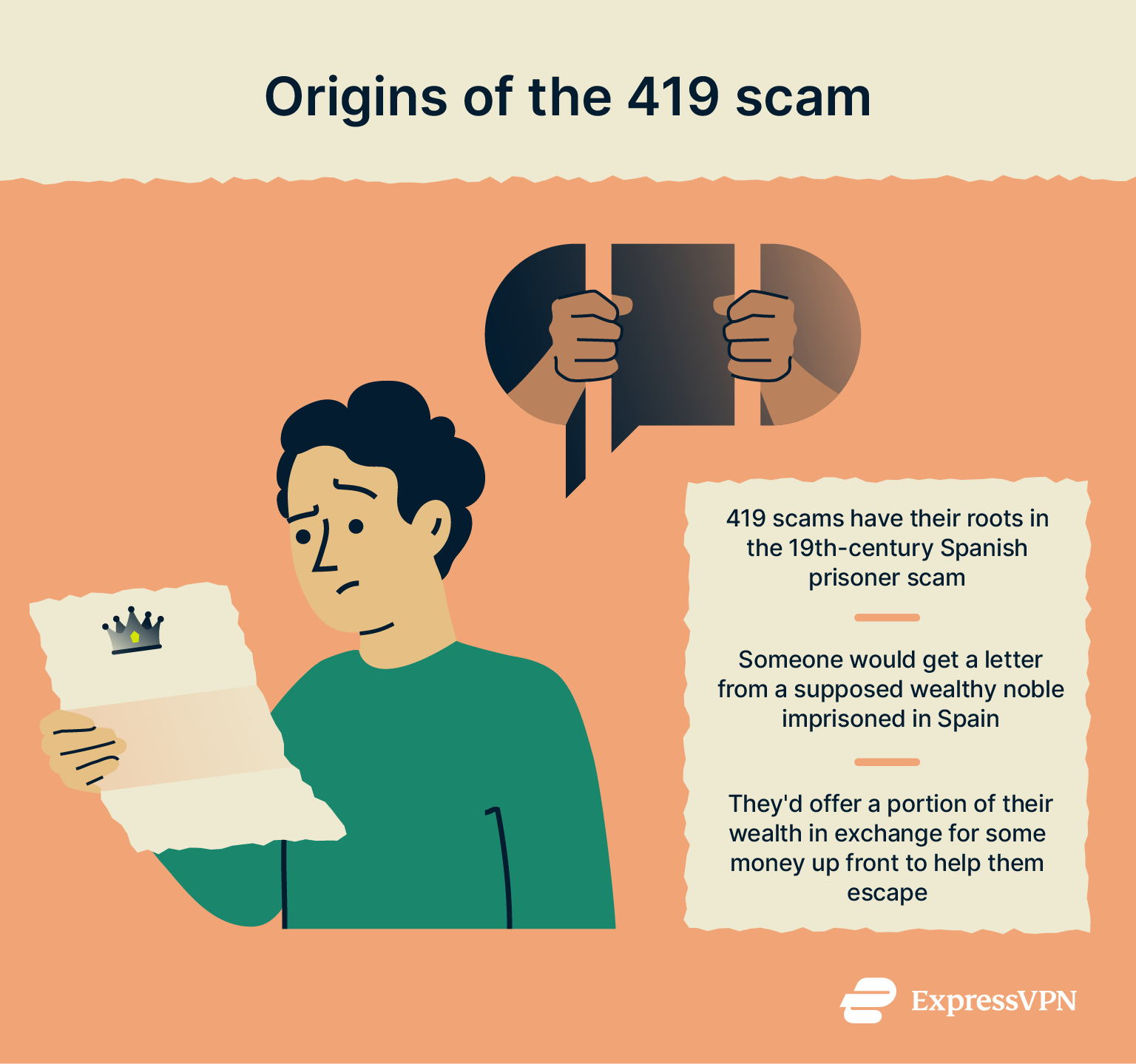

The origins of the 419 scam

The proper name for a Nigerian prince scam is a 419 scam, referring to Section 419 of the Nigerian criminal code. The roots of the scam trace back to the 19th-century Spanish prisoner scam. Someone would receive a letter in the mail from someone claiming to be a wealthy noble imprisoned in Spain. They claimed to need financial assistance to escape and promised a share of their wealth in return. This was then replicated in relation to other countries, such as Germany, and by individual con artists like William Thompson. In the 1980s, variations of this scam began appearing in Nigeria, but it wasn’t until the rise of the internet in the 1990s that advance fee scams became widespread. Email allowed 419 scammers to reach a global audience with minimal effort. From there, the scam became one of the most prolific and recognizable criminal schemes in the world.

In the 1980s, variations of this scam began appearing in Nigeria, but it wasn’t until the rise of the internet in the 1990s that advance fee scams became widespread. Email allowed 419 scammers to reach a global audience with minimal effort. From there, the scam became one of the most prolific and recognizable criminal schemes in the world.

Why it’s called the “Nigerian prince” scam

The term comes from the common narrative used in these frauds. Scammers send emails claiming to be from a Nigerian prince who needs help accessing their money. Although Nigeria has no official royal family, traditional chiefs still exist; scammers use the title “prince” to suggest wealth and status.

How the Nigerian prince scam works

A Nigerian prince scam essentially works in 3 parts: initial contact, trust-building, and then requests for money.

The initial email approach

To start, the scammer drafts an email with an elaborate story, namely that they’re a Nigerian prince or government official whose funds have been locked away and made inaccessible. They promise the victim a sizable reward, sometimes in the millions, in exchange for help.

One common tactic used by Nigerian prince scammers is to deliberately include typos or poor grammar. It serves to immediately filter out anyone who might be suspicious of the scam, leaving only the most susceptible victims to respond.

Social engineering tactics used

After the victim responds, the scammer begins employing social engineering techniques designed to gain their trust. This might come in the form of legitimate-looking documents proving what they’re saying, forged legal correspondence, deepfake voice calls, AI-generated videos, and more.

When they build rapport, the scammer introduces the idea of an advance fee. Essentially, they need money up front in exchange for a large reward later on.

Regardless of the tactic used, the goal is to put someone in a state of mind where they are willing to send a stranger thousands of dollars.

Psychological triggers behind the scam

The Nigerian prince scam relies on several key psychological triggers.

- Greed: They prey on people’s greed with the allure of easy money. The promise of a massive reward for minimal effort is intended to cloud a person’s judgment for just long enough that they’ll go along with the scam.

- Authority and trust: Claiming to be a prince or official can lend an air of legitimacy. People are more inclined to think that a real prince will deliver the rewards they promise and can be trusted to make good on their deal.

- Urgency: They create a sense of urgency by pretending that the problem is time-sensitive. This pushes people to act immediately, before they get a chance to think it through.

Examples of the 419 scam

419 scams encompass more than traditional Nigerian prince schemes. Here are a few examples of common advance-fee scams.

Classic Nigerian prince email

This is the classic archetype of the 419 scam. Victims receive an email from someone who claims to be royalty, typically a Nigerian prince. They need help moving millions of dollars out of their country, but for whatever reason, they can’t do it themselves. All the victim needs to do is pay them a small advance, and then the prince will give them a massive reward. Once they get paid, either the scammer disappears or they string the victim along with more bogus fees.

Lottery and prize scams

Victims will receive an email, phone call, letter, or message over social media saying they’ve won a major lottery, sweepstakes, or international draw. But, before they can draw their winnings, they need to pay a fee or the taxes for the lottery.

Compensation and inheritance scams

In a fake inheritance scam, scammers claim you're owed money due to a past transaction, inheritance, or government settlement. Victims are told they’re entitled to millions but need to pay a release or processing fee first. Sometimes, these scammers pretend to be from a law firm representing a deceased relative you’ve never heard of.

Romance scams and online dating fraud

Scammers build trust by pretending to fall in love with the victim over dating apps, social media, or email. After weeks, months, or even years of emotional investment, they fabricate an emergency like medical bills, visa issues, or travel costs and ask for money. If the victim sends money once, normally these scams will start ramping up as the criminal makes more and more requests under the guise of love. These scams are among the most financially and emotionally damaging.

Is the Nigerian prince scam still active today?

Yes, advance-fee scams like the Nigerian prince scam are still around and are increasing in sophistication. Scammers have refined their tactics and created more elaborate social engineering schemes, which improves their chances of success.

Modern variants of the scam

Because Nigerian prince scams are so well known, criminals needed to develop more sophisticated scams. While each of these is different, they’re all ultimately advance-fee scams.

- Election scams: It’s become common for scammers to impersonate election candidates who then ask for an investment in their political cause. This type of scam saw flare-ups during the 2024 U.S. election.

- Fake business opportunities: Posing as investors or partners, scammers promise huge returns if you wire a “setup” fee. Sometimes, these scammers pretend that the investment is a risk-free business transaction.

- Business email compromise scams: Modern scammers impersonate a CEO or business executive to trick employees into transferring money over to them.

- Job offer scams: Fake recruiters offer you a dream role, after you pay for background checks, training, or equipment.

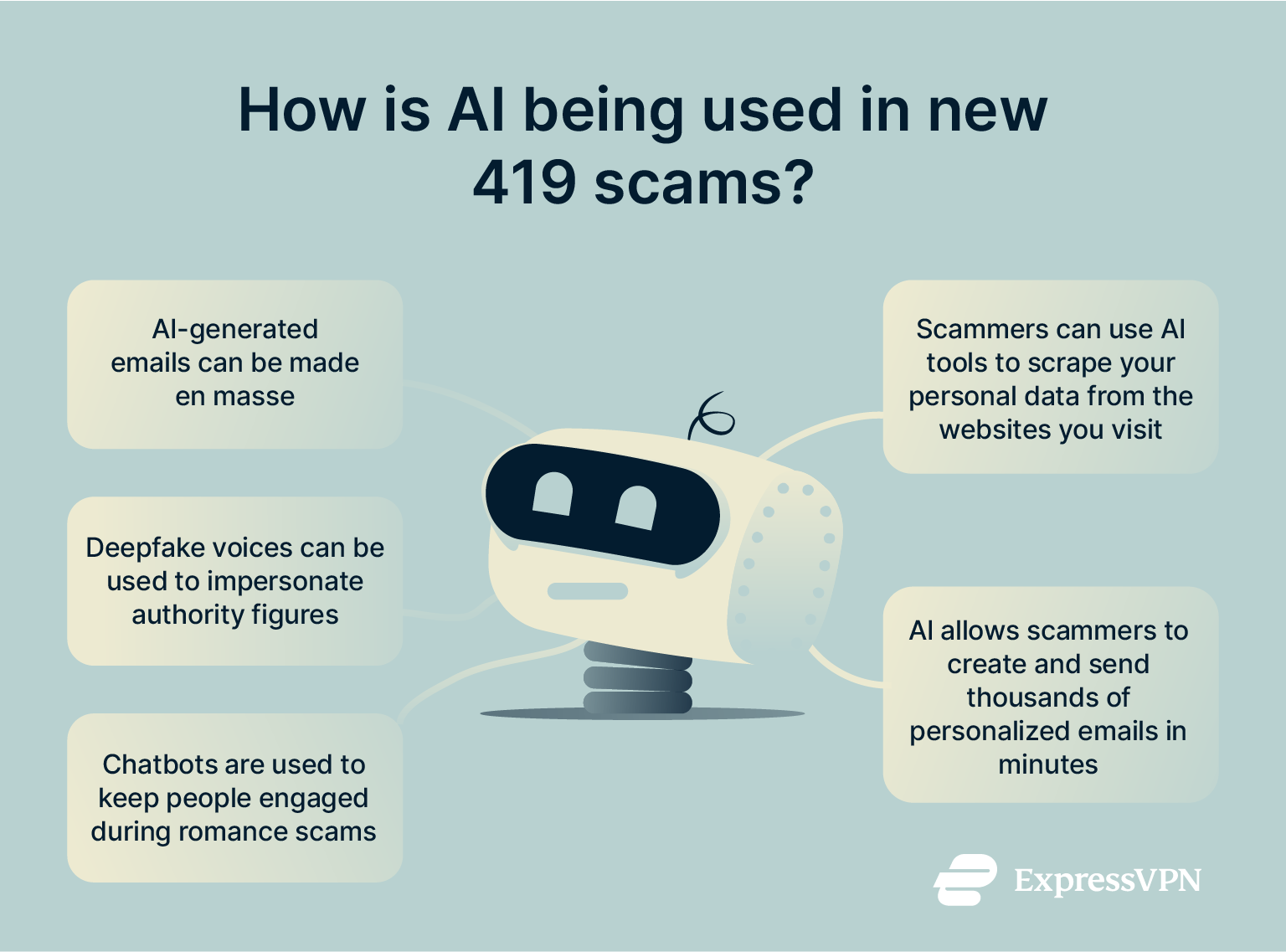

How AI is being used in new scam versions

Criminals use AI tools to improve nearly every aspect of their scams, from the quality of their writing to the scalability of the scam. For example:

- AI-generated emails: AI can be used to quickly create extremely convincing fake documents that are free of typos or grammatical mistakes.

- Deepfake voices: Some scammers use deepfake voices to impersonate CEOs, government figures, or loved ones to make their scams more convincing.

- Chatbots: AI chatbots are used to carry out long conversations over time with a victim. They’re associated mostly with romance scams, where the scammer will keep a victim talking with a chatbot until they’re ready to ask for money.

- Data scraping: Scammers use AI tools to scrape your data from the websites that you visit. This way, they can learn your name, age, job, hobbies, and email address before ever contacting you.

- Automation: AI lets scammers rapidly scale their criminal activity by creating thousands of personalized messages per minute while automatically distributing these to marked victims.

How scammers get your contact information

Scammers employ a range of illegal tactics to scrape your personal information and use it against you later on.

Data leaks and hacked databases

Massive data breaches from major companies have exposed billions of email addresses, passwords, and phone numbers over the past decade. After a threat actor obtains this stolen data, they sell it over the dark web or upload it to various databases. Criminals then purchase this leaked data for use in scams.

Social media and public information

Scammers scrape data from your public social media accounts or other websites that you visit, hoping to gather your data. They hunt for information like your friends or family, travel plans, your hobbies, or anything else they can use to carefully craft a personalized scam.

Email phishing and spoofing techniques

Scammers often send emails that look like they’re from trusted sources like your bank, a government agency, a friend, or a family member. They use spoofing techniques to fake the sender address and phishing links to lure you into clicking. These messages usually urge quick action, hoping you won’t notice subtle red flags before it’s too late. After you’ve accidentally given them your personal information, they can launch personalized scams against you to steal your money.

How to protect yourself against email scams

419 scams can be devastating, but fortunately, it’s fairly easy to spot them.

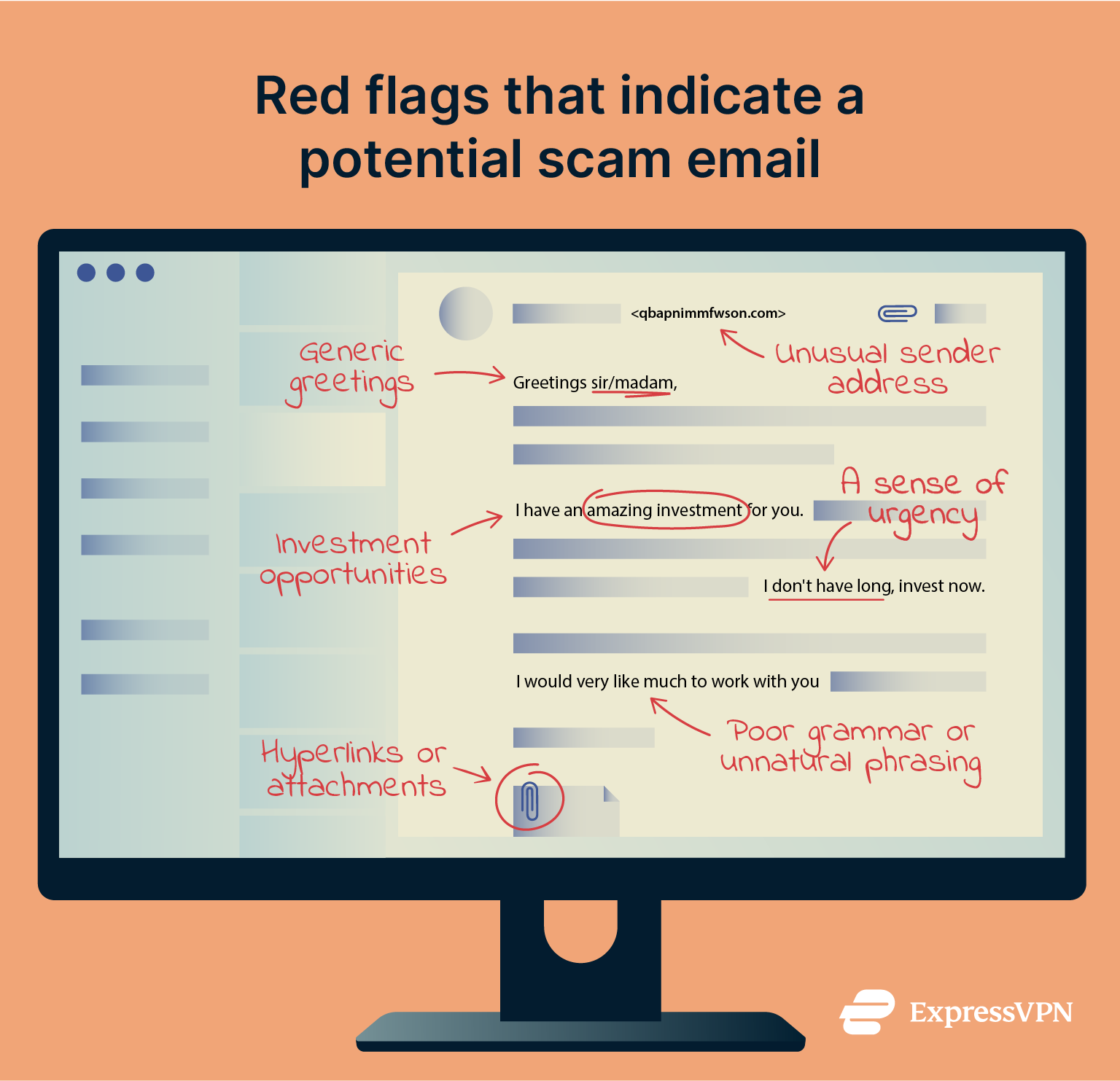

Red flags to watch for in scam emails

There are a few red flags you should always watch for whenever opening an unsolicited email.

- Hyperlinks or attachments: You should always be skeptical of unsolicited emails containing hyperlinks or attachments, as these can harbor dangerous malware or direct you to phishing websites designed to steal your data.

- Requests to send money or personal data in advance: Be extremely skeptical whenever someone promises an unrealistic reward in exchange for sending them money or personal data.

- Investment opportunities: Unsolicited emails with great investment opportunities are almost always scams, such as a Nigerian prince who claims he’ll send you back more money in return. This also applies to Ponzi schemes, cryptocurrency investments, and other types of opportunities.

- Unusual sender address: Pay attention to the sender’s address. If the sender is claiming to represent a business or impersonating an authority figure, make sure their address matches the official email. Look for strange spellings or unusual domains.

- Poor grammar or unnatural phrasing: In the past, you could tell a Nigerian prince scam by its poor grammar. With the onset of AI tools that can create legitimate-looking messages, it’s harder to find scams this way. Now, you need to look for unnatural phrasing as well as typos.

- Generic greetings: Don’t trust emails with overly generic greetings like “Dear sir/madam” or “Greetings.” Many scammers send the same email out to large numbers of people at once, hoping that just one person will respond.

- A sense of urgency: Scammers typically use language to impress a sense of urgency into the victim. Consider it a massive red flag if the sender is trying to convince you that something is time-sensitive.

Best practices to avoid online scams

One of the best ways to improve your online security is to follow healthy practices for protecting your email and online identity.

- Use a spam filter: Most email services and social media have built-in spam filters, but there are also third-party filters you can set up for extra protection.

- Keep your software up-to-date: Hackers often target vulnerabilities within outdated email services, apps, and devices to spam you with 419 scam attempts.

- Don’t share your personal information: Avoid sharing your name, address, phone number, or other sensitive data with strangers over the internet, especially if they’re promising a reward in exchange.

- Avoid replying to suspicious emails, texts, or calls: Never respond to a potential scam. Just responding to a scammer's email tells them that you’re an active user and makes them more likely to target you again.

- Password safety: Use strong, unique passwords and enable two-factor authentication (2FA) on every account tied to your email address.

- Use multiple email accounts: This way, it’s harder for a hacker to lock you out of your email, and you have less personal information concentrated in one account.

- Use anti-phishing protection: Opt for ExpressVPN Advanced Protection or another anti-phishing tool to protect you from malicious links.

Reporting and blocking scammers

If you receive a suspicious email, text, or social media message, do not reply or click on any links. Instead, report it immediately. Most email services, phone providers, and social media apps let you block and report individual users. Reporting them also allows the app or service to investigate the user and determine whether they need to be removed from the platform.

What to do if you fall victim to the Nigerian prince scam

Falling victim to a scam can be overwhelming, but it’s important to stay calm and take the right steps.

How to report the scam to authorities

To start, log everything. Take screenshots of everything the scammer has said to you, receipts for any money you’ve sent, and bank documents. Once you have a comprehensive log, you need to provide official reports to law enforcement.

You should report scams to national or regional cybercrime agencies as soon as you can. In the U.S., for example, forward phishing emails to the Federal Trade Commission (FTC) or the Internet Crime Complaint Center (IC3).

After that, put in an official report with your local authorities. Provide them with everything that you were able to log about the attack. This way, they can open up an investigation.

Can you recover lost money?

It’s possible to recover money lost to a Nigerian prince scam, but it’s difficult. If you act very quickly and contact your bank, you may be able to place a hold on the transaction or even reverse it.

However, wire transfer fraud and cryptocurrency trades are much harder to recover. Scammers usually launder the money instead of transferring it into their accounts, making it harder to track.

You need to be particularly careful while trying to recover stolen money, as many scammers attempt to hit the same target twice. They may send another email claiming to represent a private firm or law enforcement and tell you that they can help you recover your stolen money for a small retainer fee. By giving them money, you are just getting scammed again.

Psychological and emotional impact on victims

The effects of these scams go beyond financial loss. Victims often experience guilt, shame, anxiety, or even depression, especially those who kept the scam private for fear of judgment. These effects can linger for months or years, depending on the victim. They can cause deep-rooted trust issues that cause you to see the world through a paranoid lens.

If you are struggling emotionally after being scammed, it’s important to seek professional help.

Global impact of the Nigerian prince scam

How much money has been stolen?

It’s impossible to tell exactly how much money has been stolen as a result of the Nigerian prince scam, due to a lack of accurate reporting. However, scams as a whole cost the world trillions each year.

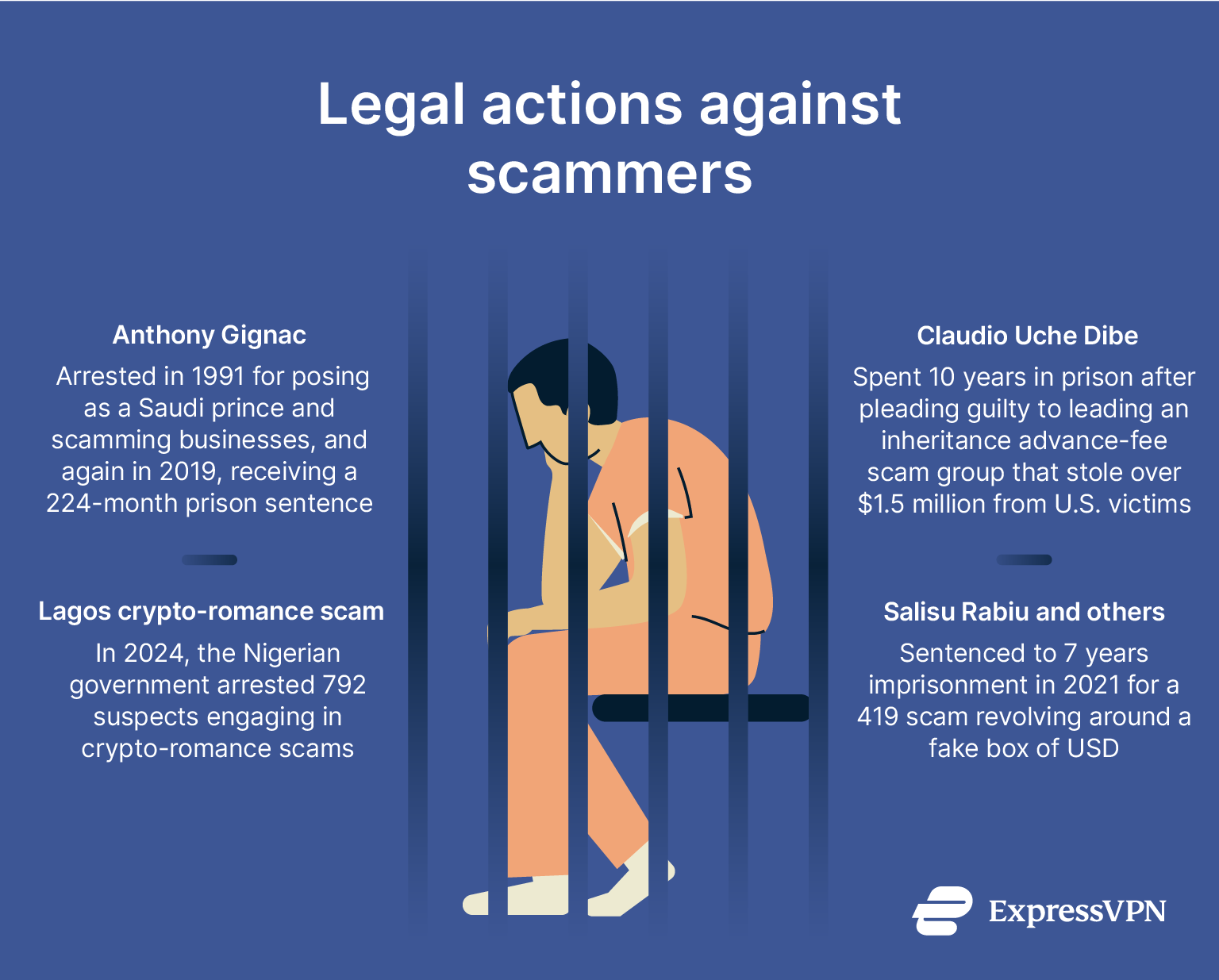

Legal actions against scammers

International government agencies have intensified their efforts to find and prosecute 419 scammers over the past decades, leading to multiple high-profile takedowns.

- Anthony Gignac: Anthony Gignac of Florida was arrested in 1991 for conning a series of businesses by posing as a Saudi prince. He served two years. Afterward, he continued to pose as a Saudi prince in order to swindle millions from investors. He was caught again and sentenced to 224 months in prison in 2019.

- Lagos crypto-romance scam: In 2024, the Nigerian government conducted a raid on a building that served as a hub for online romance scammers. 792 suspects were apprehended during the raid.

- Claudio Uche Dibe: Dibe was the ringleader of an inheritance advance-fee scam group that stole over $1.5 million from U.S. victims. He eventually pleaded guilty to 15 counts of wire fraud and spent 10 years in prison.

- Salisu Rabiu and others: A tip from a would-be victim led the Nigerian Economic and Financial Crimes Commission (EFCC) to capture several Nigerian nationals engaged in a 419 scam. Their tactic was to pretend that they needed help recovering a fake box of USD. They were sentenced to seven years’ imprisonment in 2021.

How governments are fighting online fraud

Over the past decades, governments around the world have intensified their efforts to find and capture scammers, including Nigerian prince scammers. This is often through international coordination between law enforcement agencies. At the same time, most countries have worked to improve their national cybersecurity defenses through new laws, agencies, and technologies.

Nigeria itself has taken significant steps through its EFCC. While it was initially criticized for being ineffective, it now conducts large-scale operations to take down whole cybercriminal rings.

FAQ: Common questions about the Nigerian prince scam

Why do people still fall for this scam?

Can you get in trouble for responding?

Are there other scams similar to this?

What tactics do Nigerian scammers use?

How is AI being used in new scam versions?

Take the first step to protect yourself online. Try ExpressVPN risk-free.

Get ExpressVPN